Whether you signed a brand deal, sold your biggest art piece, or got an advance, dealing with a big chunk of money can be stressful.

If it's publicly known, people may come out of the woodworks. Because everyone starts to care when the money's coming in, right..?

No matter the situation, there are a few things that you should do when you get a large amount of money:

COGS stands for "cost of goods sold". For a traditional business, like a clothing company, this would be the cost of material & production. They need to account for these costs when considering how to price products and who to choose as a supplier/manufacturer.

For your creative business, this may be contractor costs to fulfill the project requests or production costs to finish the film.

Depending on how you get paid will influence how you manage this money.

For example, if you signed a contract for $250k to create a film but you only get paid 50% upfront, you need to know that you’re only working with $125k maximum until the project is complete.

Knowing this, you'd then want to create a budget for those dollars so you know exactly where they're going. Then you can see how much you'll have left, how much you can pay yourself, etc.

✅ Tip: You can bridge unexpected or overage costs with credit cards (have a pay off plan ready), but being aware of how cash is coming in and what your costs are will make a lump sum of money much more manageable.

If you’re getting paid for something that has no (or minimal) costs - congrats, you’re in a beautiful business model.

Keep your margins high and get ready for the next step.

Whatever you do, please pay your taxes.

I dislike my dollars disappearing just as much as you, but there’s genuinely no other option than to pay them so it’s best to do it right and make it as easy as possible for yourself.

Because taxes are complex and very unique to your own situation, my general rule of thumb advice is to set aside 25-30% of whatever you get and put it in a separate bank account.

If you got $50,000, move $12-15k over immediately. If it ends up being too much, that’s fine - you can transfer it right back at any time.

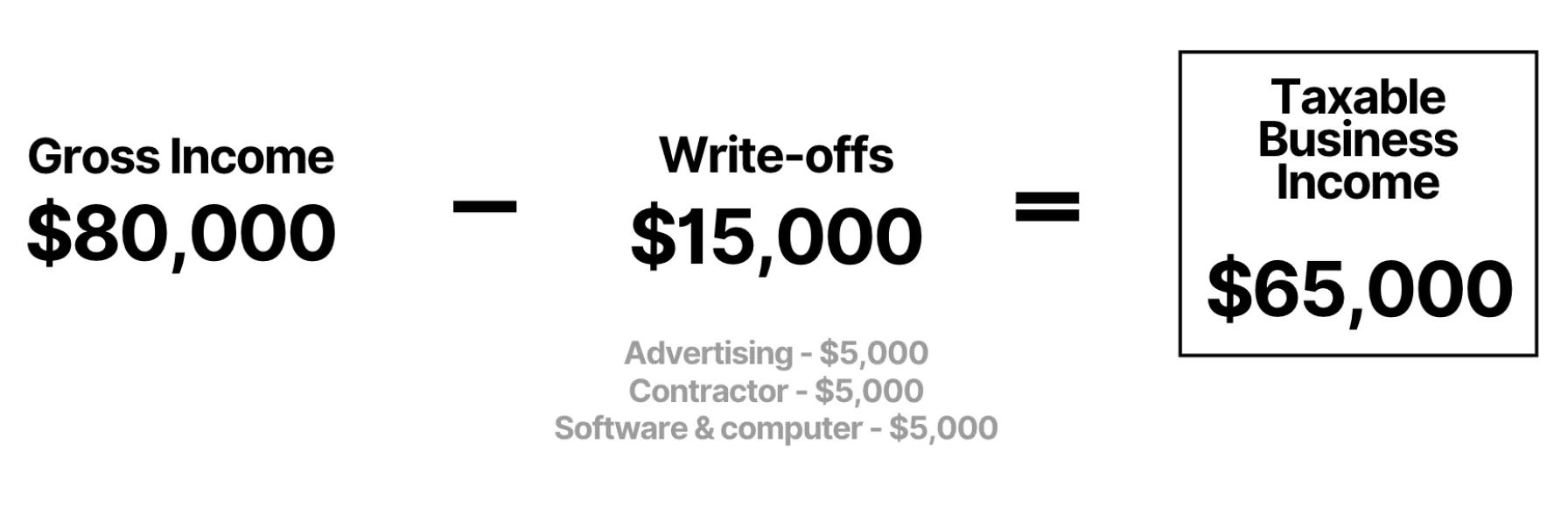

Now, I listed withholding taxes as the second step because your cost of goods sold (and other business expenses) can reduce how much you owe in taxes. To help make sense of this, here’s a quick explainer:

In this example, if you made $80,000 last year as a freelancer and you had $15,000 in eligible business expenses, you would be able to “write off” that $15,000 against your taxable income ($80k), so that you’d only owe taxes on $65,000.

If you didn't write off the expenses, you'd owe taxes on the full $80,000 and end up paying more than you needed to.

So, because necessary business expenses can be used to lower your taxable income, you don't necessarily have to calculate taxes on the full amount of money you get. Your official tax rate will depend on a lot of things—such as your marital status, number of kids, type of business, and more—but the important thing to know is that you have to set aside some portion of the funds for taxes.

You can use a calculator like this to get a better idea of what the tax liability would be for unique situation, but my best advice is to work with a tax professional (CPA or EA).

When you're making a lot of money the cost of advice is much less than the cost of a mistake.

Mr. Beast is the most prolific YouTuber in history. The biggest reason? He invests every dollar back into his business:

If you have plans to keep growing and expanding your business, you'd want to reinvest some of your earnings back into something you believe would provide a positive return.

Some examples of this in my freelance business:

All of these costs provided immediate returns to my business.

Some better than others, but I spend the money with an intention of a return.

The best way to avoid blowing through newly acquired money is to limit your access to it.

Instead of taking the leftover money and putting it in your checking account, set it aside in a different account and create a regular automation that "pays you" just like a salary.

You could put $50,000 in a high-yield savings account, earn 2-4%, and set it so every two weeks $1,000 is transferred to your checking account.

This can help the lump sum feel less overwhelming and lets you maintain regular cash flow.

In tandem with putting yourself on payroll, take some of the money and enjoy yourself.

Money’s meant to be in motion.

Donate to a charity. Start a garden. Eat better food. Spend more time outside. Do something.

If everyone in the country saved every dollar, we’d collapse in an instant. Take care of your financial goals, then deploy the rest however you please.

Whatever you’ve been dedicating your time to to earn this money, you deserve a mental break - enjoy yourself.

If you're on track with your long term goals, don't stress about spending what you have.

If building wealth is part of your plan, you can't spend all the money you make. You have to invest portions of it into things can make you more money over time, such as:

I've written more in-depth about investing in a few other articles on the blog: